Following its approval last winter, and the public’s successful and litigated request for it be put to a vote, Trigg County Board of Education officials voted unanimously in favor to rescind its efforts for a re-callable nickel tax Thursday night — effectively ending a current pursuit for building fund increases in the district.

Though it’s possible this school board, or any future ones, could once again call for the nickel, precedent created over this last year through Trigg County Circuit Court and Judge Natalie White almost guarantees the general public in and around Cadiz will demand it be on local ballots — in the primary, in the general or in a special-called session.

Sources indicate any later pursuit of the nickel will likely include even more transparency of the district’s needs, which at the moment involve major improvements to all four main school buildings — but especially to Trigg County High School, home of the Wildcats, as it’s currently the facility in most disrepair.

Nickel taxes, by law, can only be used for school building funds.

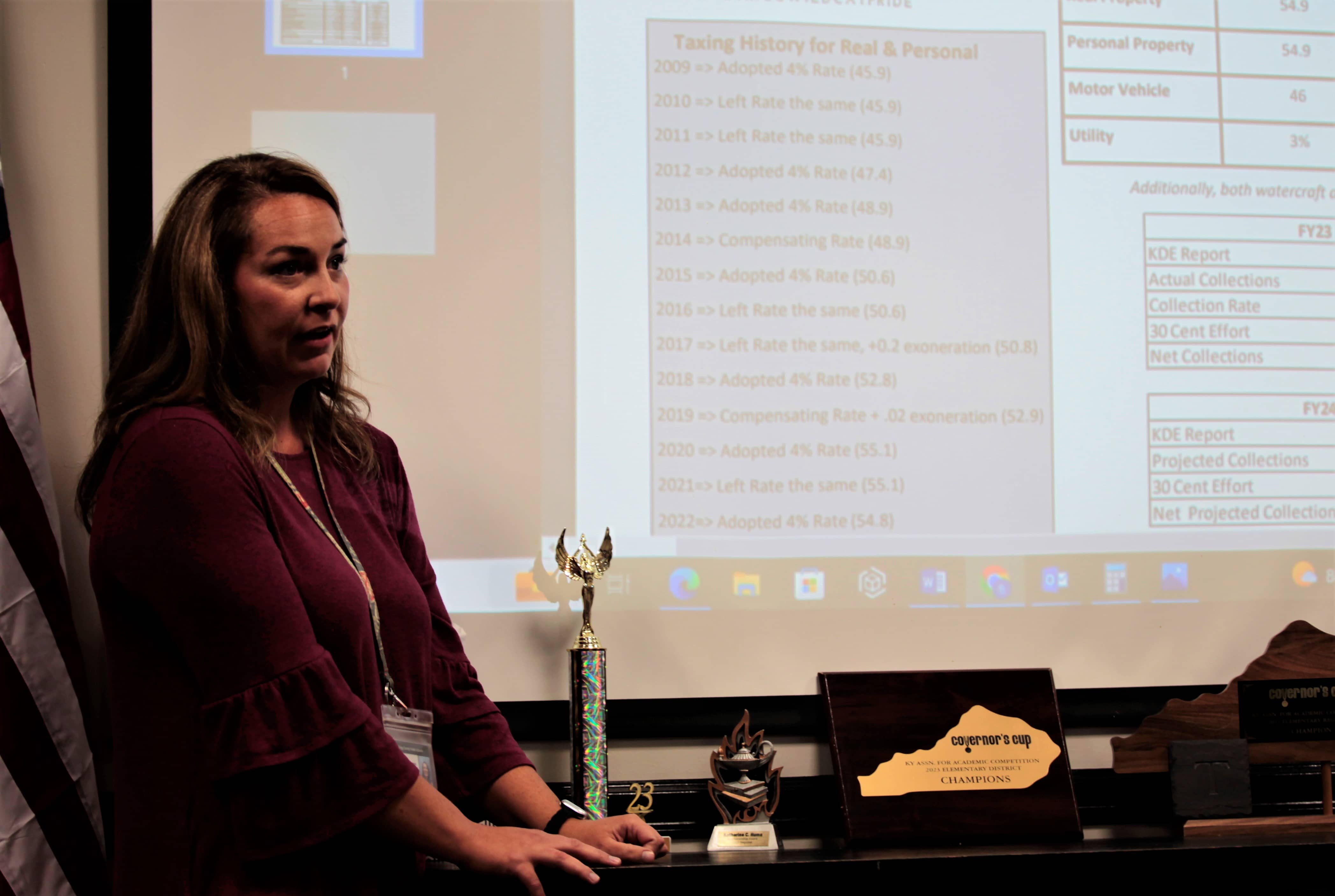

What was also discussed and approved late Thursday night was the adoption of the 4% tax rate of 53.8 cents, with an additional .3 cents for exonerations, per $100 of assessed property value for real, and 54.9 cents per $100 of assessed property value for personal plats. The utility tax rate was set at 3%, the motor vehicle tax rate was set at 46 cents per $100 of assessment.

Tax rates set at 4% or below legally do not require a tax hearing.

Chief Finance Officer Holly Greene lauded PVA Lauren Fowler and her staff for the quick submission of the county’s tax data to the state, allowing the district ample time to prepare for what could be true hurdle in the 2023-24 fiscal year.

In a 20-minute tax lesson, Greene confirmed the district is staring at a $600,000 state appropriation and collection loss in the 2023-24 fiscal year.

To further clarify this, Greene offered two sets of data: one for fiscal year 2023, and one for fiscal year 2024.

In 2023, the Kentucky Department of Education Report expected Trigg County to collect nearly $6 million in taxes. A 93% collection rate, due to a myriad of legal factors, put total collections at $5.6 million. A 30-cent effort resulted in $3.73 million going to the Commonwealth, and net collections were valued at $1.87 million.

In 2024, the KDE Report is expecting $6.3 million in collections, with a 93% collection rate slated at roughly $5.9 million. A 30-cent effort comes in at $4 million, leaving the district with $1.87 million.

And it’s not even break even.

Trigg County’s SEEK funding, she added, is where the majority of loss will occur: down from $6.9 million in 2023 to $6.3 million in 2024. And this doesn’t include the 4% tax collection fee assessed by the Trigg County Sheriff’s Office, for its efforts in serving notices.

SEEK, or the Support Education Excellence in Kentucky program, is a formula-driven allocation of state-provided funds to local school districts.

By virtue, and by taking the 4%, this district gains nothing.

Greene also illustrated Trigg County Schools’ tax history timeline from the last 15 years, which is worth noting for those keeping count:

— In 2009, the board adopted the 4% rate, which was 45.9 cents per $100;

— This stayed the same in 2010 and 2011;

— In 2012, the board adopted the 4% rate again, which was bumped to 47.4 cents per $100;

— In 2013, the board adopted the 4% rate, but it was bumped up to 48.9 cents per $100;

— The board took the compensating rate in 2014;

— Adopted the 4% rate of 50.6 cents in 2015;

— Kept the rates the same in 2016;

— Left the rates the same, but added 0.2 cents for exonerations in 2017;

— Adopted the 4% in 2018, now at 52.8 cents per $100;

— Took the compensating rate plus 0.2 cents of exonerations in 2019;

— Adopted the 4% rate of 55.1 cents per $100 in 2020;

— Left that alone in 2021, right after COVID-19;

— And took the 4% in the past two years.

Unlike city and county government, school districts are beholden to the Kentucky Department of Education and the Kentucky General Assembly, which set tax rates and SEEK models for the Commonwealth.