Hopkinsville City Council will consider a real property tax rate of 22.5 cents per $100 of assessment which Chief Financial Officer Robert Martin said was the lowest tax rate in over three decades.

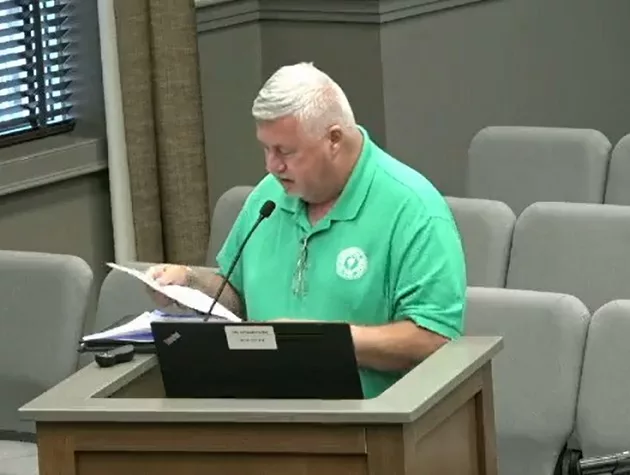

Martin presented the 2022 property tax rates to the Committee of the Whole at Thursday night’s meeting and said this was a year PVA did a major reassessment of property within the city limits. He added this allows them a rare opportunity that they can take the maximum rate allowed by the state and it’s still lower than the previous year’s rate.

He said the maximum rate they can take this year is 22.5 cents, a 5.9% decrease in the tax rate.

He said there was a jump in the assessed value this year and explained if they took a lower tax rate the city would lose over $180,000 in potential revenue this year.

click to download audioMartin also noted any recommendations about new buildings or renovations are going to require a bond issue. He added there is no way around that and this is a way they can make that debt service by setting aside the $184,000 every year, which would be favorable to get a bond issue.

click to download audioHe recommended they take the real property tax rate of 22.5, which will be would be an increase for some individuals and businesses.

click to download audioAlong with the real property tax rate, Martin recommended the city take the same tax rates as last year of 23.9 cents on personal property and 25.1 cents on motor vehicles, which was approved to forward to the city council by a 7-2 vote. Councilmen Chuck Crabtree and Terry Parker were the nay votes. Council members Kim McCarley, Alethea West and Phillip Brooks were absent from the meeting.